The venture capital (VC) landscape is evolving rapidly, with significant growth in sectors driven by technological innovation and sustainability. For the industrial sector, which has traditionally been more conservative in adopting new technologies, venture capital is opening doors to unprecedented opportunities. This shift is enabling startups and established industrial companies to attract funding for cutting-edge solutions. From advanced manufacturing and automation to green technologies, investors are increasingly eyeing opportunities to disrupt traditional industrial processes and improve efficiencies across the board.

In this blog, we will explore the key trends and investment themes driving venture capital in the industrial sector.

1. Green Technology and Sustainability in the Industrial Sector

Sustainability has become a cornerstone of industrial investments as companies and investors align their strategies with environmental, social, and governance (ESG) principles. Venture capitalists are actively funding startups that develop green technologies, aiming to reduce the industrial sector’s carbon footprint. From renewable energy sources to carbon capture and storage (CCS) technologies, the push for eco-friendly innovations is strong. This trend is reshaping traditional industries, such as mining, manufacturing, and logistics, and driving interest in sectors that focus on clean energy, waste reduction, and sustainable production processes.

Some key areas within this trend include:

- Circular economy initiatives: Promoting reuse and recycling of materials.

- Energy-efficient manufacturing: Implementing renewable energy sources in factories and production lines.

- Water conservation technologies: Improving water management in heavy industries.

2. Industrial Automation and Robotics

The future of manufacturing lies in automation. Startups that are driving innovations in robotics, artificial intelligence (AI), and machine learning (ML) are receiving substantial venture capital investments. The adoption of smart factories, where machines and systems operate autonomously with minimal human intervention, is transforming traditional production processes.

Venture capitalists are focusing on startups that leverage:

- Robotic process automation (RPA): Automating repetitive tasks in industrial processes.

- AI-driven supply chains: Optimizing inventory management, reducing waste, and increasing operational efficiency.

- Predictive maintenance: Using machine learning to monitor equipment and predict failures, reducing downtime and maintenance costs.

The potential for industrial automation to improve productivity and cut costs makes this sector highly attractive to VC investors.

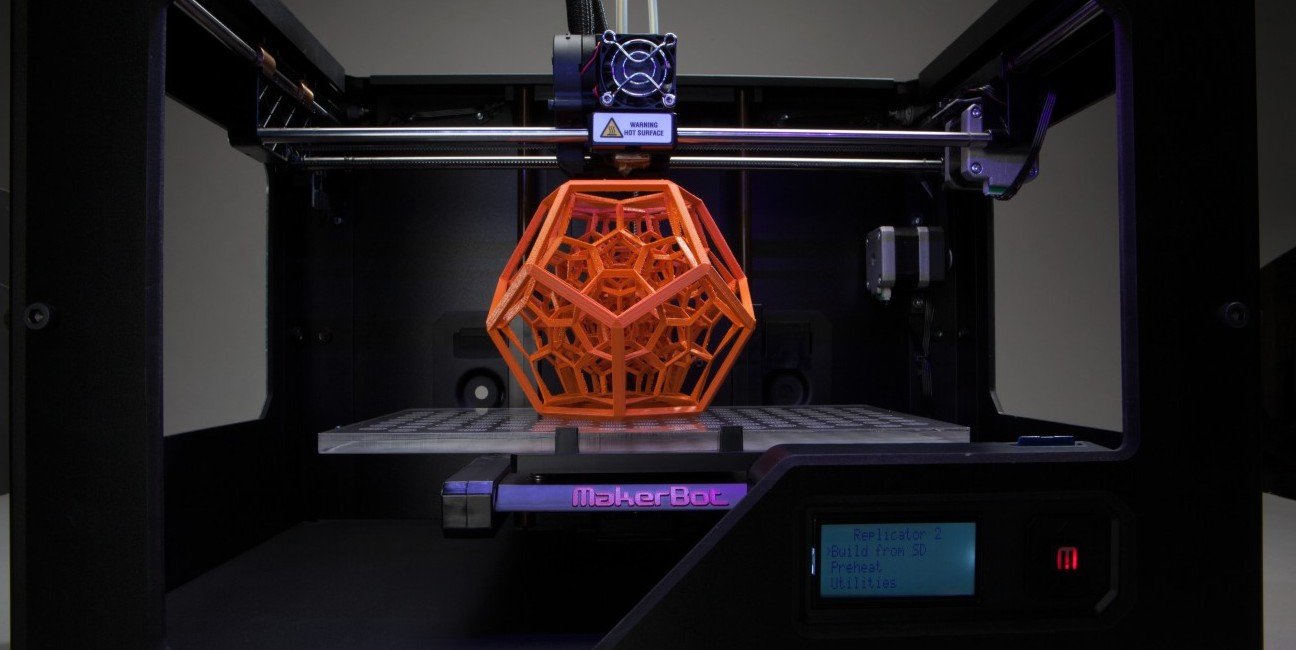

3. 3D Printing and Advanced Manufacturing

Additive manufacturing, or 3D printing, is revolutionizing industrial production by offering more flexible and cost-effective manufacturing options. The ability to produce complex parts on-demand and with minimal waste is a game-changer for industries like aerospace, automotive, and healthcare. Venture capital investments are pouring into startups that offer 3D printing solutions, from new materials and printing technologies to software that integrates additive manufacturing into existing supply chains.

Key trends in this space include:

- Metal 3D printing: Enabling the production of strong, durable components for heavy industries.

- On-demand production: Reducing the need for large inventories by producing parts as needed.

- Customization: Allowing manufacturers to produce bespoke products tailored to specific customer requirements.

As more industries explore the benefits of 3D printing, the opportunities for venture capital investments in this space continue to grow.

4. Industrial IoT and Data-Driven Manufacturing

The Internet of Things (IoT) is expanding across industrial sectors, enabling better connectivity and data collection throughout the manufacturing process. The industrial IoT (IIoT) refers to the use of interconnected devices that communicate and share data across production lines, warehouses, and even logistics networks. This data-driven approach allows companies to optimize production, improve safety, and reduce waste.

Venture capitalists are particularly interested in IIoT solutions that offer:

- Real-time monitoring: Allowing for continuous tracking of equipment performance and factory operations.

- Big data analytics: Leveraging data from connected devices to drive improvements in efficiency and decision-making.

- Digital twins: Creating digital replicas of physical assets to simulate and optimize processes.

Investments in IIoT are enabling the development of smart factories and data-driven manufacturing ecosystems, making this an exciting area for venture capital.

5. Supply Chain Innovation and Resilience

Global supply chains have faced unprecedented disruptions in recent years, forcing companies to rethink their approaches to supply chain management. Venture capital is flowing into startups that provide innovative solutions to make supply chains more resilient, efficient, and transparent. Technologies like blockchain are being used to track goods from production to delivery, ensuring greater accountability and reducing fraud.

Investment themes within supply chain innovation include:

- Blockchain for supply chain transparency: Ensuring visibility and traceability across all stages of the supply chain.

- AI and ML for demand forecasting: Improving accuracy in predicting supply and demand to prevent shortages or overproduction.

- Last-mile delivery optimization: Using AI-driven logistics to improve the efficiency of product delivery to end consumers.

By focusing on supply chain innovation, venture capitalists are helping industries mitigate risks and adapt to new market challenges.

6. Energy Storage and Electric Vehicles

Energy storage and electric vehicles (EVs) are at the forefront of the industrial sector’s transformation towards sustainable energy solutions. Venture capital is being directed towards startups developing advanced energy storage systems that can support renewable energy adoption. These systems are critical for industries seeking to reduce reliance on fossil fuels and shift towards greener operations.

Additionally, the rise of EVs is creating new opportunities for venture capital in industries such as logistics, transportation, and mining. Companies that develop EV infrastructure, such as charging stations and battery technologies, are attracting significant investments.

Key trends include:

- Battery innovation: Enhancing energy storage capacity and lifespan.

- EV supply chain development: Creating sustainable supply chains for electric vehicle manufacturing.

- Grid integration: Supporting the integration of renewable energy sources with industrial power grids.

Conclusion

The venture capital landscape in the industrial sector is evolving rapidly, with emerging sectors such as green technology, industrial automation, 3D printing, and supply chain innovation attracting substantial investment. For venture capitalists, these sectors represent significant opportunities for growth as industries seek to modernize, become more efficient, and adopt sustainable practices.

By focusing on key trends such as sustainability, automation, and IoT-driven manufacturing, venture capitalists can drive innovation in the industrial sector and unlock new avenues for success. As the industrial landscape continues to evolve, those who invest in these emerging sectors will be well-positioned to capitalize on the future of industry.